Blog

Best Practices for Maintaining Regulatory Compliance in Middle East

Best Practices for Maintaining Regulatory Compliance in the Middle East

As the Middle East positions itself as a global IT hub and businesses go through rapid digital transformation, data privacy is taking center stage. As a result, government and regulatory bodies across the Middle East institute regulatory standards, laws, and guidelines for organizations to protect sensitive data, minimize risks, and enhance operational integrity.

For businesses, these regulatory guidelines in the Middle East aren’t just a legal requirement but a vital step for thriving in the region’s increasingly dynamic business environment. Today, 91% of organizations in the region believe that compliance pressures are taking up a significant proportion of their time and resources.

Non-compliance with regulatory guidelines in the Middle East comes with steep penalties. It often leads to high fines, operational shutdowns, legal battles, and damage to reputation. In industries like finance and healthcare, non-compliance may result in losing critical business licenses or permanent bans from operating in the region.

Having a robust compliance management strategy can help you avoid such penalties, build trust with your stakeholders, and enhance operational efficiency.

Regulatory Compliance in the Middle East

Regulatory compliance in the Middle East is as diverse as its business landscape. Different countries, sectors, and authorities—each with its own set of requirements—make compliance a moving target.

Key regulatory bodies such as the Saudi Central Bank (SAMA) in Saudi Arabia, and the Central Bank of the UAE (CBUAE) play critical roles in shaping financial and data security regulations. These organizations enforce stringent anti-money laundering (AML) laws, cybersecurity frameworks, and financial reporting standards to maintain transparency and accountability in the financial sector.

In the healthcare and oil & gas sectors, compliance falls under the oversight of bodies like the Ministry of Health or the National Electronic Security Authority (NESA), which regulate everything from data privacy to critical infrastructure protection. Let’s have a deeper look into these regulatory compliance standards in the Middle East.

Industry-Specific Compliance Guidelines

The Middle East is vast, and so are its regulatory guidelines. Different industries come with different regulatory compliance requirements. Let’s break them down:

Finance:

Financial institutions across the Middle East face stringent regulations for anti-money laundering (AML), financial disclosures, and capital market transactions. The Capital Market Authority and SAMA regulations in KSA mandate financial institutions to maintain strong cybersecurity protocols for protecting customer information. Failure to comply with these regulations leads to hefty fines and legal penalties, and can even get your license revoked.

Healthcare:

Compliance requirements in the healthcare industry centers around data protection, especially given the sensitive nature of patient information. The Abu Dhabi Healthcare Information and Cyber Security (ADHICS) imposes stringent regulations to maintain the confidentiality, integrity, and protection of patient data across the nation’s healthcare centers. To adhere to ADHICS, organizations are required to adhere to a total of 692 controls across 11 domains.

Oil & Gas:

Oil and gas companies need to protect their critical infrastructure and protect data from cyber threats. UAE’s National Electronic Security Authority (NESA) provides regulatory guidelines for risk management, incident response, and the establishment of a strong cybersecurity framework that organizations need to follow.

Meeting these compliance requirements warrants businesses to adopt a proactive approach, implementing systems and processes that ensure compliance is continuous—not just an afterthought.

Regional Variations in Compliance

With cyber threats increasing and data privacy getting threatened, each country in the Middle East has its set of regulations and legal frameworks for enhancing cybersecurity. Which is why compliance is not generalized across the Middle East. What works in the UAE might not be enough for Saudi Arabia or Qatar.

For instance, the UAE has a relatively business-friendly environment but maintains its own robust cybersecurity and financial regulations. Its Personal Data Protection Law (PDPL) sets strict standards for data collection and storage that align with GDPR.

On the other hand, the Kingdom of Saudi Arabia has some of the strictest laws for data protection and regulations for ethical AI use under its Saudi Data and Artificial Intelligence Authority (SDAIA). The SAMA also outlines comprehensive guidelines on cybersecurity, data protection, and PDPL.

Qatar, meanwhile, operates under the strict supervision of QFCRA for financial institutions, and businesses must regularly report their activities and compliance status to avoid penalties.

For multinational businesses, it’s essential to understand the different regulatory nuances and set up customized compliance strategies for each country—which is no small feat.

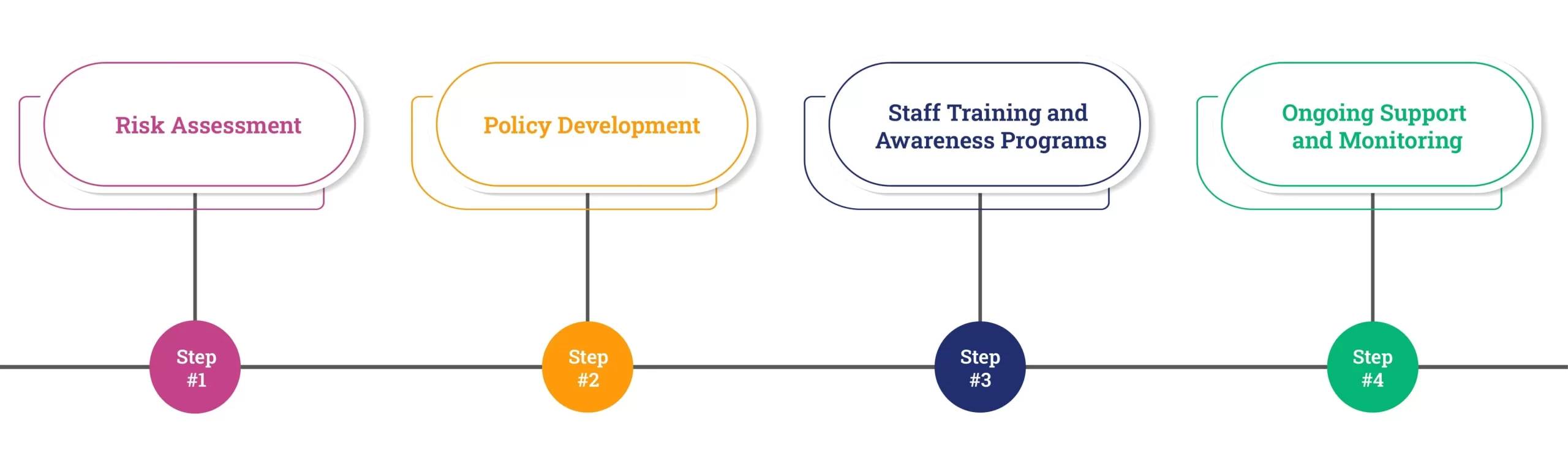

Comprehensive Compliance Strategies

As we’ve seen above, regulatory compliance in the Middle East warrants a proactive approach that aligns with your business objectives while minimizing risk.

A well-structured compliance strategy safeguards your operations, keeps you ahead of regulatory changes, and fosters trust with your stakeholders. Here’s how to build one:

Step #1 Risk Assessment

You need to know where you stand before you can protect yourself. Begin with a thorough risk assessment to find compliance gaps and inefficiencies. Identify your organization’s exposure points, and evaluate how compliance requirements in the Middle East apply to your business operations.

Step #2 Policy Development

Based on the risk assessment, develop comprehensive compliance policies. These should address not only local regulations but also sector-specific mandates. Think of this as your compliance blueprint.

Step #3 Staff Training and Awareness Programs

Regularly train your staff on your compliance policies and the legal requirements specific to their roles. Make sure they understand the consequences of non-compliance. It also helps to conduct awareness programs and foster a proactive operational culture toward regulatory compliance in the Middle East.

Step #4 Ongoing Support and Monitoring

Compliance is not a one-time task. Set up continuous monitoring systems to track compliance performance, detect potential violations, and address them proactively. Ongoing support and regular audits from compliance experts can help you stay up-to-date with changing regulations and ensure you’re always prepared for inspections or audits.

Today, technology and automation are completely redefining regulatory compliance. Implementing risk and compliance management tools can streamline processes such as reporting, monitoring, and document management.

Not only do these solutions reduce the risk of human error, but they also provide real-time visibility into your compliance status, ensuring that your organization is always audit-ready and responsive to regulatory changes.

PwC reports that 70% of businesses in the Middle East will incorporate AI into their compliance programs by 2025.

Best Practices for Regulatory Compliance in the Middle East

Here are some best practices to help you stay on top of regulatory compliance in the Middle East:

Conduct Regular Audits

Internal audits help catch potential compliance issues before regulators do. They allow you to assess your current compliance status, identify gaps, and take corrective action.

Conduct sector-specific audits or focus on areas prone to non-compliance. For example, financial institutions should dig deeper into anti-money laundering (AML) controls, while healthcare organizations need to focus on data protection under ADHICS regulations.

Stay Current with Regulatory Changes

Regulations change frequently, and staying updated is essential. Leverage compliance management tools that automatically track regulatory changes in real time and provide instant updates to your team. Additionally, collaborating with local legal experts who remain up-to-date with the latest regulations can be invaluable.

Maintain Clear Documentation

Proper documentation is not just a best practice—it’s a necessity. Keep up-to-date records on your compliance activities, from policy updates to staff training sessions.

Use compliance management software that organizes your records and offers version control for policy changes. This ensures you’re always audit-ready, protecting your business from legal disputes.

Given the importance of maintaining regulatory compliance in the Middle East, it’s best to create a culture of compliance throughout your organization. Embed compliance into the DNA of your enterprise—every team member must understand and prioritize compliance in their daily operations.

When compliance becomes a priority to everyone, from leadership to frontline employees, your organization’s risks of violations and gaps can shrink down to zero.

When compliance becomes a priority to everyone, from leadership to frontline employees, your organization’s risks of violations and gaps can shrink down to zero.

How Paramount Can Help You Meet Compliance Standards

Achieving regulatory compliance in the Middle East can take it out of you, but it doesn’t have to be a solo effort. At Paramount, we specialize in providing tailored compliance management solutions in the Middle East.

Our team of cybersecurity experts with 100000+ days of experience understands the unique compliance challenges in the region and offers advanced strategies for meeting your industry and regional requirements.

No one understands the Middle Eastern compliance landscape like we do. In our 30 years of operational experience, we’ve helped 100+ businesses across the BFSI, Oil and Gas, and Government sectors achieve compliance and optimize their cybersecurity posture.

Conclusion

Navigating the regulatory landscape in the Middle East isn’t easy, but with the right strategies in place, it’s manageable. A proactive, well-rounded compliance strategy is essential to your business’s long-term success—allowing you to mitigate risks, avoid legal penalties, and build trust with your stakeholders.

Staying informed, adapting to new regulations, and embedding compliance into your company culture will give you the foresight to act before risks escalate.

At Paramount, we combine tailored solutions with our rich industry expertise to help you meet all Middle Eastern compliance requirements and stay ahead of your competitors and evolving regulations.

Recent Posts

- GRC Implementation Challenges

- Essentials To Achieve Information Security Compliance

- Effective Data Security Strategies: A Comprehensive Guide for Middle Eastern Businesses

- The Most Critical Cyber Threats Middle East Businesses Face

- 8 IAM Challenges Every Organization Faces and How to Tackle Them Using Identity Data Analytics

Protect your online assets from cyber threats with Paramount

Comprehensive cyber security solutions for individuals and businesses

Significantly reduce the risk of cyber threats and ensure a safer digital environment.