Bank operated in multiple countries with different compliance standards. Its management processes relied heavily on manual procedures and legacy tools. This meant limited visibility into possible potential financial and reputational losses

How the Archer GRC Platform helped a middle east bank take better business desisions?

Summary

This major Middle East bank with a global presence global presence had to grapple with multiple reporting formats and compliance standards. Their GRC processes were mostly manual that were done using legacy tools. Standardized reporting of risk compliance and posture reporting was time-consuming and laborious. Also lacking was a centralized platform that prevented integrated risk reporting and risk visibility into critical risk and compliance gaps.

To deal with the complexities of modern business continuity, operational risk, and compliance reporting needs, the bank also decided to migrate from a legacy risk management tool to a modern Governance, Risk, and compliance. In consultation with Paramount the bank built a uniform and dynamic reporting structure migrating data from its legacy systems to the Archer GRC platform. They also created a common compliance framework on par with international standards.

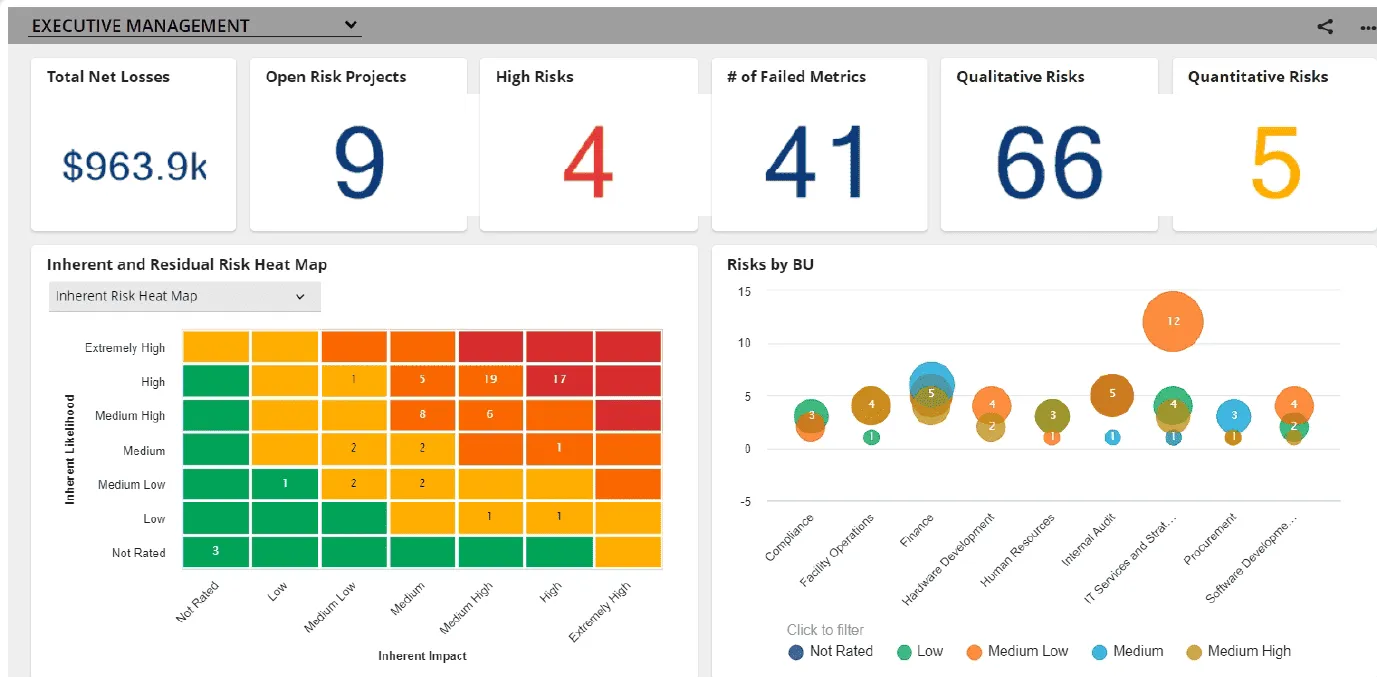

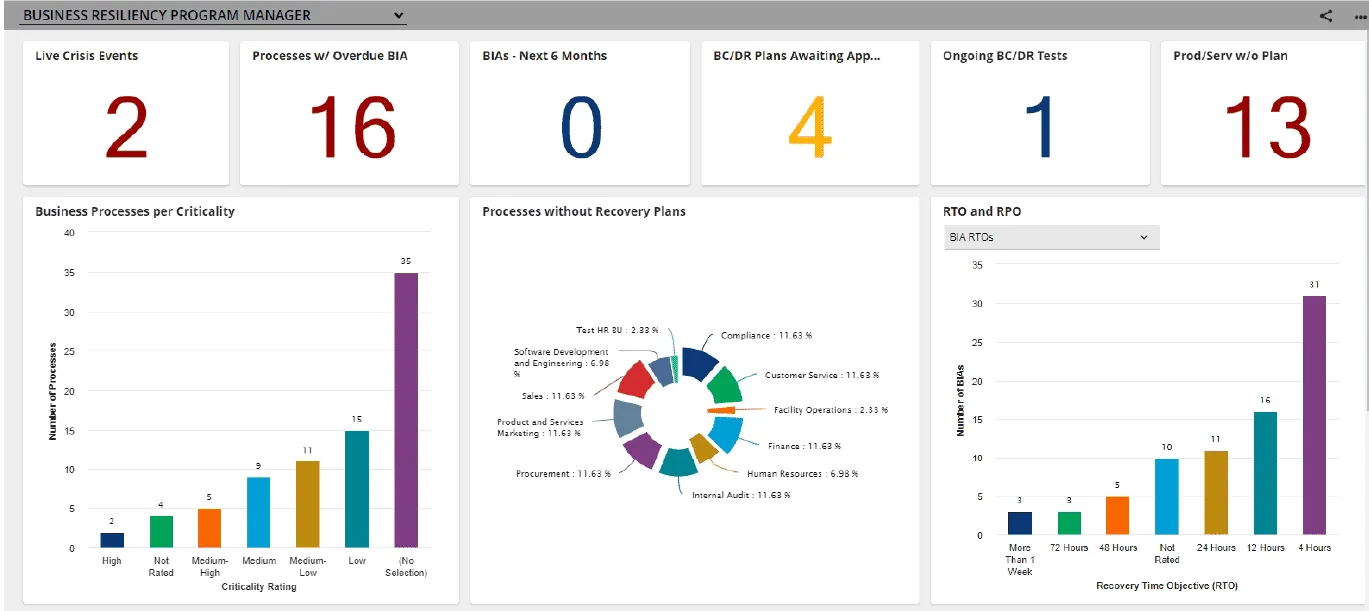

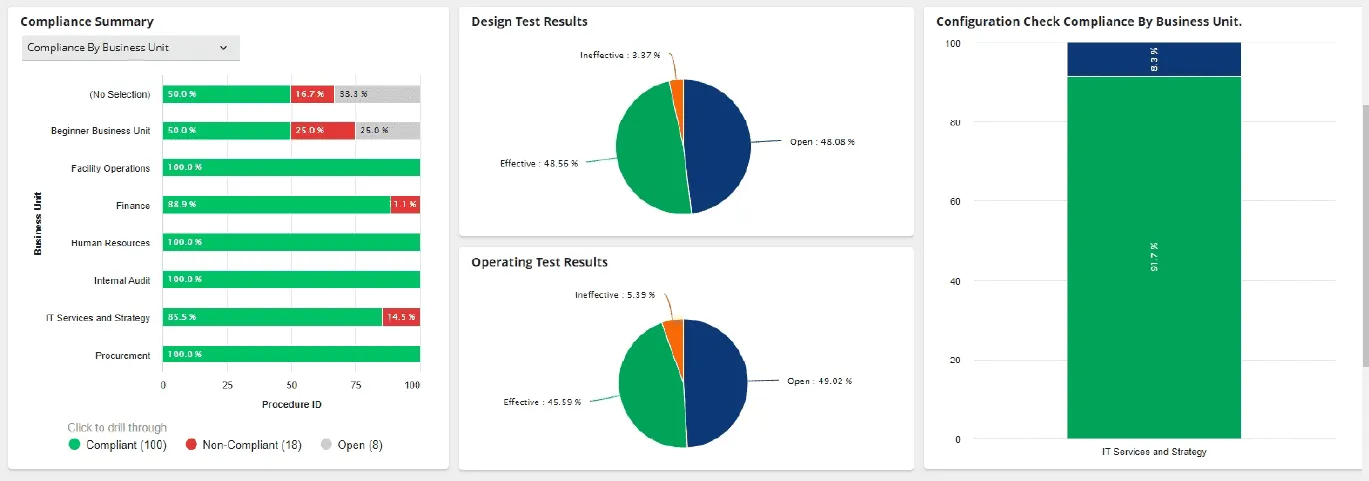

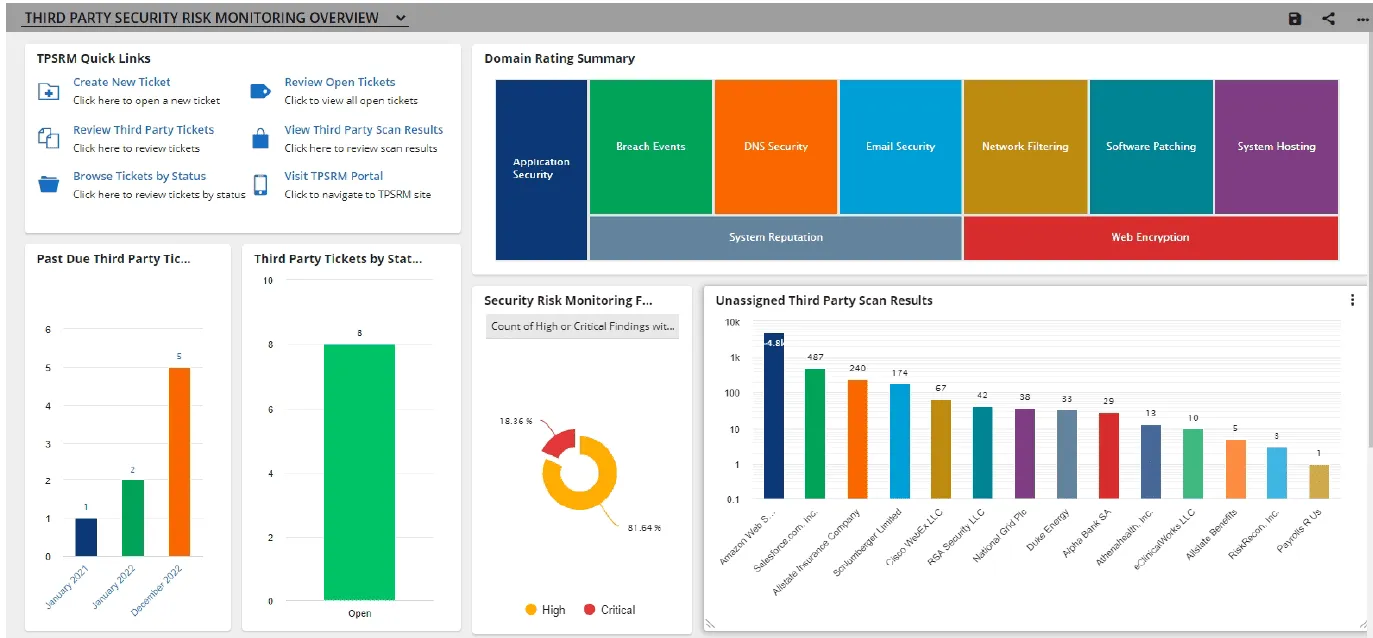

This improved the bank’s overall risk visibility and streamlined its business continuity, operational risk, and compliance processes. Monitoring risks became easy since risk, compliance issues could be spotted easily. Users could customise dashboards according to their needs and get access to information on a real-time basis

Challenge

Challenge

Solution

Solution

- Build a common compliance framework mapped to international standards enabling streamlined compliance assessments.

- Automated notifications were set up that ensured that the time spent on risk assessments reduced

Impact

Impact

Improved overall risk visibility and streamlined compliance. Risk reporting was dynamic and real time & just involved a few clicks. Enabled easy monitoring of risks.

Overview

The customer, the largest commercial bank based in Middle East, offers a comprehensive range of banking products including deposits, loans,corporate services, private banking, and investment services to its customers.

The Bank boasts of an extensive banking network, all over Middle East and international financial hubs such as London, Paris, Geneva, New York, Singapore.

The bank operates in a complex environment characterized by multiple reporting structures, complex compliance requirements, and varying risk assessments across different business units.

Specific Challenges

The bank faced several challenges that obstructed its ability to enhance risk management

- Fragmented Reporting Structures: The lack of a centralized platform prevented integrated risk reporting, leading to a lack of visibility into critical risk and compliance gaps.

- Compliance Challenges: The bank struggled with multiple compliance frameworks and regulations across various countries, making it difficult to ensure adherence and potentially exposed the bank to fines.

- Manual and Time-Consuming Processes: Monitoring and tracking various regulations required significant manual effort, leading to delays in reporting and increased risk of errors.

- Legacy Tools: The reliance on legacy reporting tools limited the efficiency of risk reporting and analysis.

- Lack of Uniform Risk Visibility: The absence of a unified risk assessment method made it challenging to calculate combined exposure to financial losses and identify top risks at the group level.

The Solution

To address these challenges and streamline its risk management processes, the bank embarked on a GRC journey. That would help the bank in the following areas

- Unified and dynamic risk reporting structure:A real-time reporting system centralized risk assessment and reporting. This centralization enabled faster decision-making by identifying and mitigating risks in a timely manner.

- Common Compliance Framework:The bank wanted to create a common compliance framework that matched international standards to establish a library of artifacts. This helped to streamline compliance assessment across various countries and proactively address potential compliance issues.

- Migration from Legacy Systems:The bank migrated from a legacy risk management tool to a modern GRC platform for long-term efficiency. Archer and Paramount ensured that migration did not effect the business as usual.

- Automation:Predefined automated work flows enabled people to concentrate on strategic tasks. Automated alert notifications served as reminders and prevented SLA breaches of routine tasks.

GRC Platform centralizes risk assessment improving compliance

Migration from Legacy Systems

State of the art GRC platform

Unified Reporting Structure

centralized risk assessment and reporting

Common Compliance Framework

Mapped to international standards

Impact of the Implementation

-

Improved overall risk visibility and streamlined compliance process

The bank was able to enhance its risk assessment processes, streamline compliance efforts, and improve overall risk visibility and reporting capabilities through the collaboration with Paramount and Archer -

Risk reporting on customised dash boards

Instead of using an outdated risk reporting system that took a long time to report, Archer’s solution now provides users a customized dash board to suit the needs of each department -

Easy monitoring of risks involved

Critical risks, compliance, KPI failures and continuity issues can now be easily spotted and resolved thanks uniform risk reporting

Way forward

The successful implementation of the GRC project has motivated the client to roll out IRM projects across other locations.

Get StartedThe components of Archer GRC solution

Archer Operational/Enterprise Risk Management Solutions

- Archer Issues Management

- Archer® Top-Down Risk Assessment

- Archer Bottom-Up Risk Assessment

- Archer Key Indicator Management

- Archer Loss Event Management

Archer Third Party Risk Management Solutions

- Third Party Catalog

- Third Party Engagement

Archer Regulatory Compliance Management Solutions

- RSA Archer® Controls

- Archer Policy Program Management

- Assurance Program Management

Archer Business Continuity Management Solutions

- Archer Business Impact Analysis

- Archer Incident Management

- Archer BC & ITDR Planning

- Archer Crisis Management

Archer for Governance, Risk, and Compliance implementation?

Archer

As a leader in cybersecurity and Governance, Risk and Compliance, Archer has been the trusted partner of over 120 organizations across the Middle East.

Leveraging our prominent position as leaders in the Gartner Magic Quadrant 2022, we harness the capabilities of the Top 10 GRC Software and Tools and combine the practical insights of over 24 on-site GRC specialists to reshape the landscape of integrated risk management.

Why Paramount?

Our unique combination of functional, technical and implementation expertise equips us with the insight to proactively address usual challenges encountered during GRC implementations.

With a team of more than 24 on-site GRC specialists, Paramount has partnered with over 35 companies in executing projects that resulted in significant time and cost savings.

Whether you are a banking and finance institution, a government agency, or a large conglomerate, Paramount is well-prepared to support you in fulfilling your Governance, Risk and Compliance objectives.