How Paramount Helped a Major Bank in the Gulf Region Automate its Manual Privacy Processes

Summary

A leading Bank in the Gulf region partnered closely with Paramount to revamp its data privacy program amid rapid growth and evolving regulatory landscapes. This Case Study explores the challenges faced by the Bank in managing sensitive personal and financial information while ensuring compliance with Qatar’s stringent data protection laws, and how Paramount with the help of Securiti.AI, automated key privacy processes, conducted extensive data discovery exercises, completing 500+ processes in just 4 months, and established a robust governance framework.

This initiative resulted in enhanced compliance, improved data governance, and greater efficiency in managing personal data, showcasing the transformative impact of technology in addressing complex data privacy challenges within the financial industry.

Specific Challenges

The Client, a leading financial institution in the Gulf region, has experienced remarkable growth in recent years, driven by its expansive customer base and evolving market demands. As data privacy regulations become increasingly stringent, the Client recognised the need to enhance its data privacy program to safeguard sensitive information and ensure regulatory compliance.

The Client faced the following challenges:

- Manual Processes: Relied heavily on manual processes for identifying, classifying, and managing personal data, which was time consuming, prone to errors, and lacked scalability

- Lack of Governance: Absence of robust governance mechanisms around the management of personal data posed significant compliance risks and hindered the bank’s ability to demonstrate regulatory compliance.

- Incomplete Data Mapping: The bank lacked comprehensive visibility into its data landscape, leading to incomplete data mapping and classification. This made it difficult to assess the impact of data processing activities on individual privacy rights

Paramount's Solution

Paramount implemented Securiti.AI, an end-to-end technology solution designed to address the bank's specific requirements. With a deep understanding of the Client’s operational landscape and regulatory obligations, Paramount crafted a tailored solution that addressed immediate challenges and laid the foundation for long-term scalability and resilience in data privacy management like:

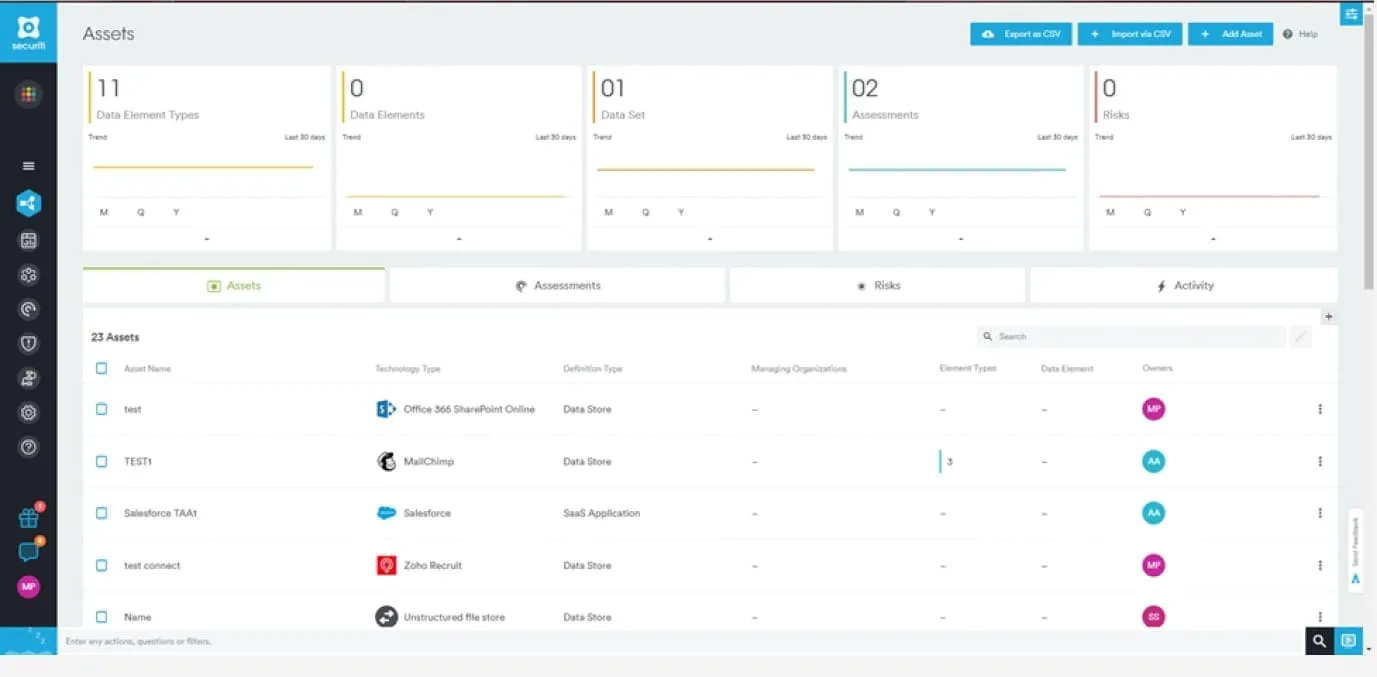

- Identifying and Classifying Personal Data: Automated identification and classification of personal data across diverse data sources by leveraging advanced algorithms and machine learning techniques.

- Governance Framework: Assisted in establishing a robust governance framework around the management of personal data. This included defining policies, procedures, and controls to ensure compliance with regulatory requirements.

- Data Mapping: Facilitated seamless integration of the platform with the bank’s existing systems, allowing for data mapping exercises. This included identifying data flows, data repositories, and data processing activities.

- Conducting Impact Assessments: Provided robust tools for conducting Data Protection Impact Assessments (DPIAs), enabling the bank to evaluate the potential risks associated with data processing activities and implement appropriate safeguards.

- Data Discovery: Conducted extensive data discovery exercises, analyzing over 500 processes within the bank’s operations. This involved identifying data flows, data dependencies, and data usage patterns.

- ROPA Awareness Program: Recognizing the importance of employee awareness in data privacy matters, Paramount conducted a ROPA (Rights of Personal Data Owners) awareness program for the bank’s staff.

- Achieving Data Completeness: Through the implementation of the Securiti.AI Platform, the bank was able to address incomplete processes and fill data gaps within their operations. This ensured a more comprehensive and accurate view of their data landscape.

Impact of the Implementation

-

Personal Data Identification:

The bank was able to identify both personal and non-personal data within its systems, providing greater clarity and transparency. -

Enhanced Data Governance:

The bank was able to establish a robust data governance framework, ensuring better control and oversight of personal data processing activities. -

Improved Compliance:

By automating key aspects of their privacy program, the bank achieved greater compliance with regulatory requirements, reducing the risk of non-compliance penalties. -

Comprehensive Data View:

Paramount’s solution provided the bank with a complete view of their data governance landscape, enabling informed decision-making and proactive risk management. -

Efficiency Gains:

Automating privacy processes resulted in significant efficiency gains for the bank, freeing up resources to focus on strategic initiatives and value-added activities

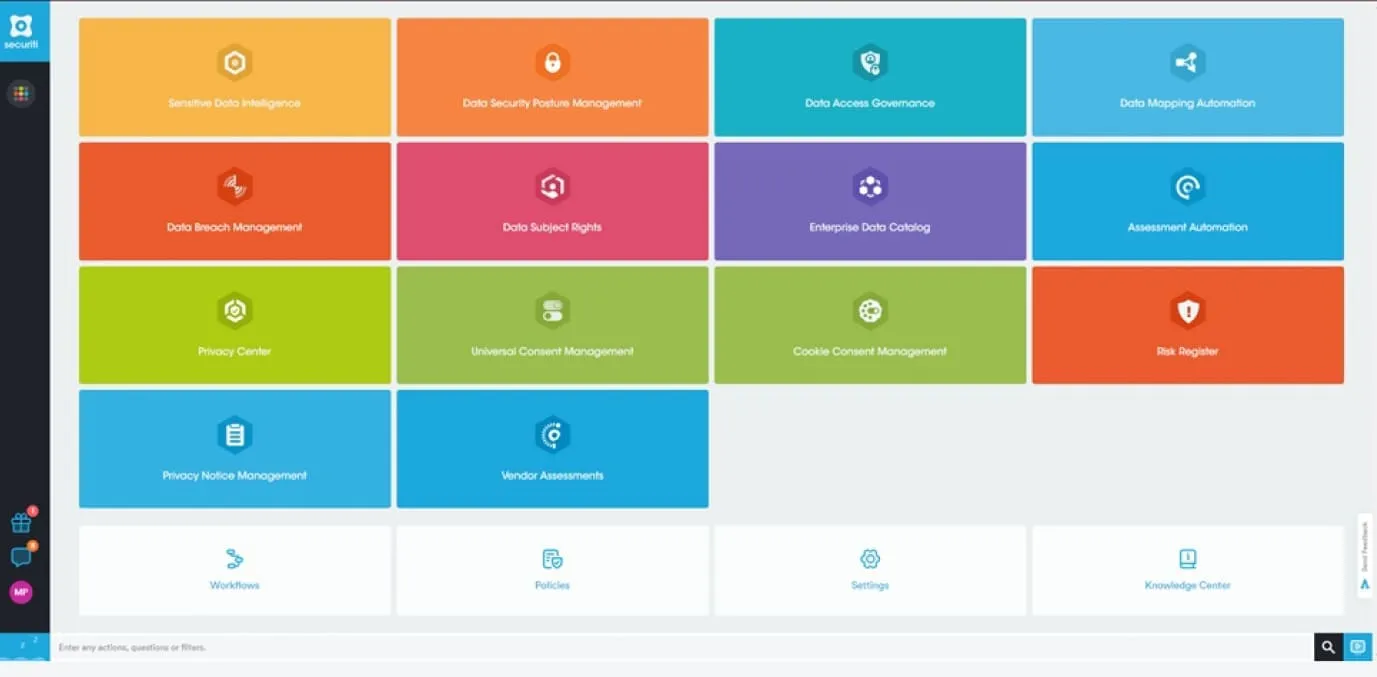

The Components of Securiti

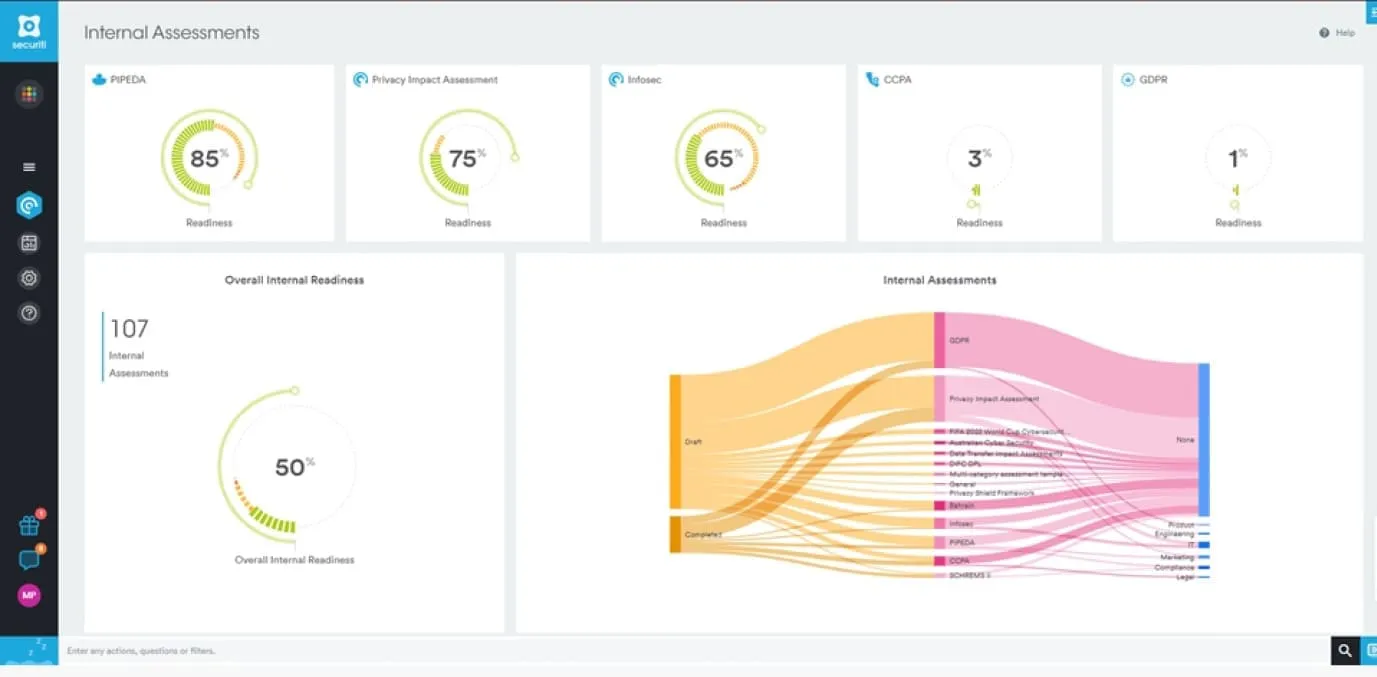

Assessment automation

Why choose Paramount & Securiti?

Securiti

Securiti.ai stands out as a leader in AI security and governance. This platform excels in automating data discovery, classification, and protection across various data environments, ensuring compliance with global privacy regulations. Securiti AI’s innovative approach helps organizations quickly identify and mitigate risks, manage data subject requests, and maintain a secure data landscape. By leveraging AI-driven insights and automation, Securiti AI empowers businesses to enhance their data security posture while reducing operational costs and complexities.

Paramount and Privacy

Paramount stands out as the best choice for businesses when it comes to privacy due to its comprehensive end to end data protection solutions. It offers consulting, services and robust tools for data discovery, risk assessment, and incident response, tailored to each business’s needs. Paramount’s commitment to staying ahead of evolving privacy laws and industry best practices ensures unparalleled protection against data breaches and regulatory fines, making it a trusted leader in safeguarding business privacy.